A big focus of the Autumn Statement on Wednesday will be economic growth.

The reason for that is simple: there isn’t any, or at least there isn’t very much.

The Autumn Statement is Westminster’s term for what amounts to a mini-budget.

The Budget itself will be in March, closer to the general election.

So ministers have to decide what to do now and what to do then.

You might have caught the rather absurd spectacle of Chancellor Jeremy Hunt volunteering for lengthy interrogations over the weekend, during which it felt like he started every other answer with “you’ll have to wait until Wednesday” or words to that effect.

He managed to say everything and nothing when it came to specifics. And the range of the briefing to reporters has been pretty broad too.

From the conversations I have had, plus what we are hearing and crucially not hearing, both in public and in private, here’s a sense of where we seem to be.

There are enough kites flying about tax that I think we can be reasonably confident there will be some tax cuts.

The question is where?

The Treasury has let most of the speculation run. In other words, it hasn’t gone out of its way to dampen down some of it.

But I expect the focus to be on business taxes – as cutting them is seen to be key to helping to get the economy growing.

A cut in National Insurance for the self-employed is seen by many as likely. Could there be a wider cut to National Insurance?

There has been a blizzard of headlines about inheritance tax.

And yes, the Treasury has considered a cut.

As discussed on the BBC’s Newscast, cuts to inheritance tax can prove popular even among those who are not likely to have to pay it.

But, it appears the government might be having second thoughts about it, given the backlash against the idea from some who say it would benefit the most well off.

Within the Treasury, one of the merits of an inheritance tax cut is they believe it wouldn’t be inflationary.

They are obsessed with ensuring that whatever they do doesn’t contribute to higher inflation.

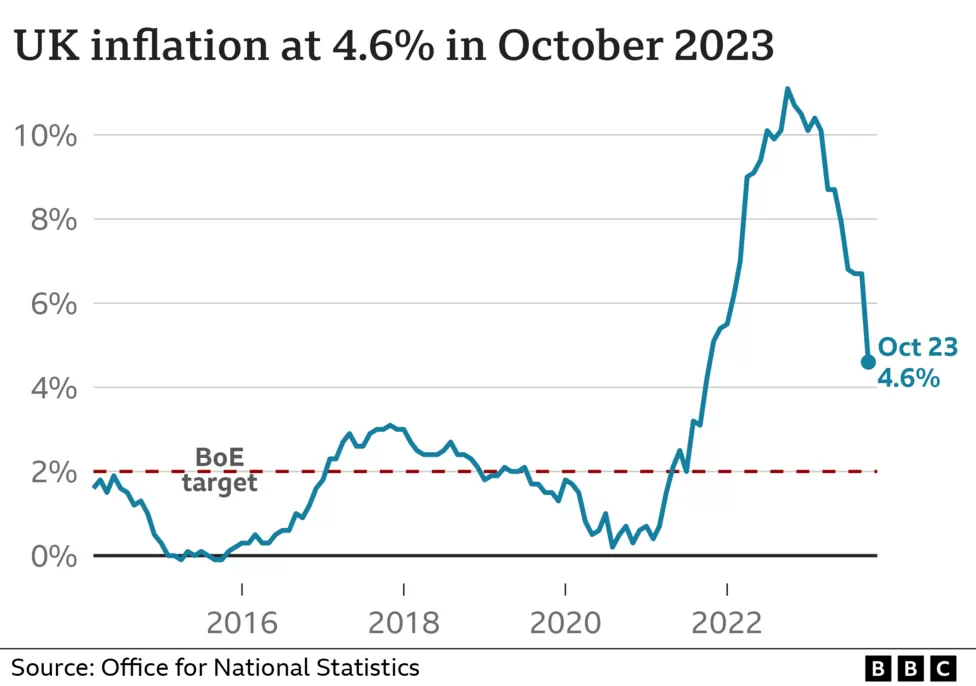

In fact we can expect a splash of pride from the prime minister and the chancellor this week that inflation has halved this year.

How they would have loved to talk about this last week.

But they were drowned out by the Supreme Court rejecting their Rwanda migrants plan.

Much of the fall in inflation is driven by factors beyond the government’s control.

But it was, arguably, the prime minister’s most important promise at the beginning of the year. And it has happened. They can at least point to things they didn’t do which would have made inflation worse.

The balance Rishi Sunak and Mr Hunt have to pull off this week is to project a sense of economic optimism and cut some taxes, but not fuel inflation. Not easy.

The last thing they need is the Bank of England cancelling anything they do by jacking up interest rates as a result.

A couple of other things to watch out for: do benefits go up next April in line with September’s (higher) inflation figure, as is convention, or October’s (lower) one? The difference – as set out here by the Institute for Fiscal Studies – is big.

And does the triple lock – which guarantees the state pension goes up by 2.5%, inflation or wages, whichever is highest – take account of one-offs in wage packets or not? If it does, it’ll be more generous, if it doesn’t, it won’t. Let’s see.

The crux of what we will get is a government in trouble arguing that it and we have turned a corner; things are looking up.

They will try to argue that incentivising businesses to grow and rewarding work through tax cuts are Conservative instincts at odds with what Labour would do.

Labour will point out that the tax burden is higher than it’s been in decades and that millions feel poorer than they did five or ten years ago – and make the argument that anything we hear from Mr Hunt won’t change that.

Source : BBC